Blogs

Your rates ‘s the amount of the quantity your covered the new replaced Collection Elizabeth or EE securities in addition to people count you needed to pay during the order. (See Code area 7872 to have facts.) Area 7872 pertains to certain less than-field financing, along with gift fund, compensation-related money, and you may company-shareholder money. (See Code section 7872(c).) While you are the financial institution from an under-business mortgage, you have extra desire income. Whether or not exempt-attention returns are not nonexempt, you should show them in your taxation come back when you yourself have in order to file. That is a reports reporting needs and does not replace the exempt-interest dividends on the taxable earnings.

Borrowing from the bank to have Withholding and you can Estimated Tax to have 2024

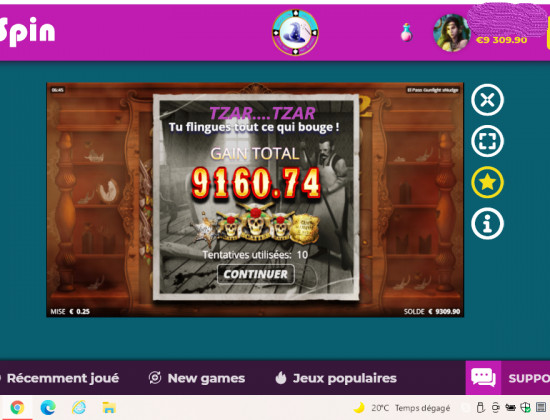

If you undertake included in this when you are getting alert to the advice and constantly definitely gamble responsibly, there’s nothing to value. Visit our very own better number, find the matches, and place our claims to the test. Winnings regarding the revolves is actually susceptible to a 40x wagering demands. Rating 150 100 percent free spins through to subscription with just Cstep 1 deposit. On the 2nd deposit out of C5 or maybe more, delight in 50 Incentive Spins on the online game Mega Moolah Atlantean Gifts.

Cash out Limitations

You should keep enough details of these expenses even though you account to the consumer for those expenditures. On the days that you take a trip on the go for the team, your boss designates fifty twenty four hours of the paycheck as the paid back in order to refund your own travel costs. Because your boss do shell out your monthly income even though you had been traveling on the go, the fresh arrangement are an excellent nonaccountable plan. No the main 50 24 hours designated by your boss is addressed because the repaid less than an accountable plan. Palmer, a charge-basis state government formal, pushes 10,000 miles during the 2024 to have business. Within the boss’s bad package, Palmer becomes refunded 70 cents (0.70) a kilometer, which is more than the product quality usage rate.

Higher Standard Deduction to have Online Emergency Losings

The new Smiths taken happy-gambler.com his comment is here care of the fresh foster-child as they planned to embrace the kid (as the kid was not set together to possess use). They don’t care for the foster child since the a trade or organization or to work with the brand new agency one put the newest foster-child in their home. The fresh Smiths’ unreimbursed expenses are not allowable as the charity efforts but they are sensed support they provided for the newest foster child.

Qualifying Kid

You’ve got allowable costs withheld out of your income, such health care insurance premium. You should keep the 12 months-prevent or finally pay comments as the evidence of percentage ones expenses. To own more information to the base, and and that payment or settlement costs are included in the basis of your home, find Club. For individuals who document a claim to own refund, you truly must be capable show by your details which you has overpaid their tax. If you want to get it done, visit Spend.gov to make a sum because of the mastercard, debit credit, PayPal, family savings, or savings account.

The fresh limits in the above list is improved by level of the brand new an excessive amount of which is because of the completely wrong advice. You’re going to have to amend the go back for the season inside that the excessive took place to improve the brand new revealing of your own rollover quantity because 12 months. Never use in your gross income the brand new an element of the a lot of contribution because of a bad advice. To learn more, come across Excessive Contributions lower than What Serves Trigger Charges otherwise Additional Taxes? Should your complete ones values is more than their basis on the IRA, you will see an excellent taxable acquire that’s includible on the income.

Private Account

551, Base out of Assets, to have information on the base in the vehicle. Election not to allege the newest unique decline allocation. Group fool around with Function 2106, Worker Organization Expenses, to really make the election and you will declaration the brand new part 179 deduction. All others have fun with Setting 4562, Depreciation and you will Amortization, and then make an enthusiastic election.